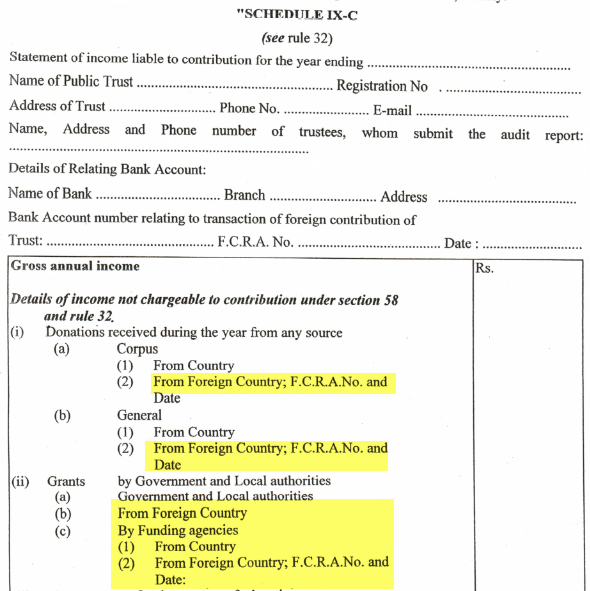

How do we know, what is the status of application of FCRA renewal ? This is the question, every organization is asking now a days. Yes, we all are waiting regarding any communication from MHA, FCRA department regarding FCRA renewal status.

What is current scenario?

As per our knowledge, no organization, throughout India has received any Renewal or Query Letter from MHA, FCRA department.

How to check FCRA Renewal Status?

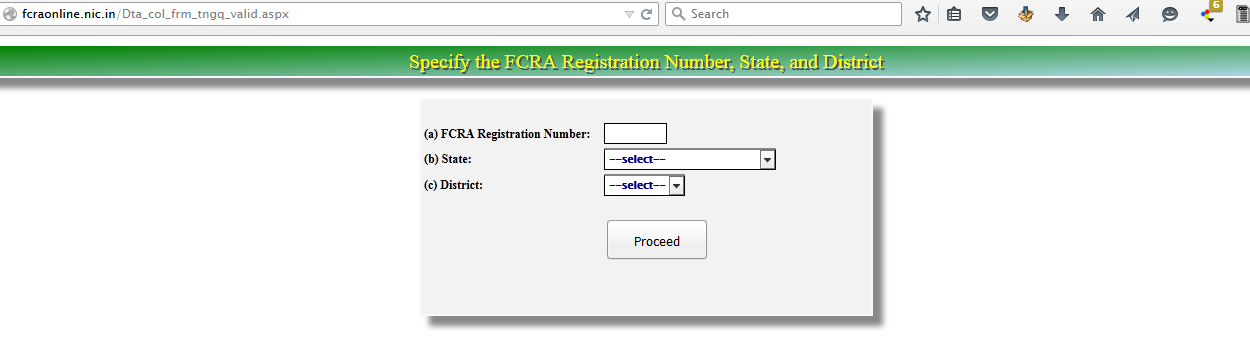

No such mechanism prescribed or available right now online to check where your application is lying. Keep visiting our blog for any new news.

Time limit for FCRA Renewal?

As per section 16 (3) of FCR Act, 2010, renewal certificate should be issued withing 90 days from the date of the application received.

section 16(3)

“The Central Government shall renew the certificate, ordinarily within ninety days from the date of receipt of application for renewal of certificate . . . .

Provided that in case the Central Government does not renew the certificate within the said period of ninety days, it shall communicate the reason thereof to the applicant”

What to do now?

Organization can email to the FCRA department to ds-fcra@nic.dot.in email address (this email address mention on the fcraonline.nic.in website) with the details on which date you apply for renewal and DD no etc..

If you get any communication from FCRA department regarding renewal or any queries, kindly post in the comment so it will be useful to other readers of this blog. Thanks.